Francesco Starace: Expectations for Infrastructure Investments in the Face of COP

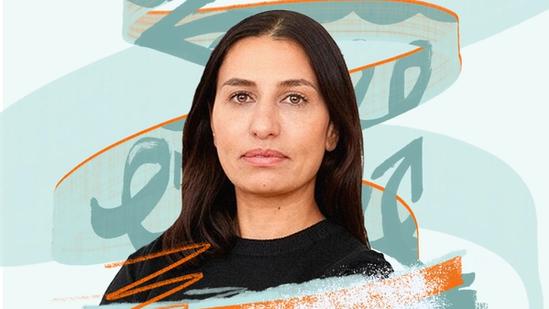

Francesco Starace, Partner at EQT, on the importance of investing in new infrastructure to change how we manage energy

How we produce and consume energy has damaged the Earth’s climate, and the negative consequences are becoming more evident with each passing year.

To change course, we need to change how we produce, transmit and use energy. The vast quantity of wasted primary energy, compared with that which we actually use, highlights the fundamental need for transformation in how energy is managed.

It starts with moving away from using the heat from burning fossil fuels as an energy source. In the past, technological limitations left us with no other choice. But today, we can avoid this dependency – and we can do so in a competitive, safe and efficient way.

Achieving this transformation requires significant investment in new infrastructure. Instead of spending trillions of dollars every year on burning fossil commodities, we need to redirect funds toward building the necessary infrastructure: generation plants, transmission lines, and smart meters, and we must modernize and digitize the distribution networks. This investment extends to reconsidering how factories generate the heat for industrial processes, how we heat and cool our homes, offices and buildings, and how we transport goods.

The scale of investment required shouldn't be underestimated. The Energy Transitions Commission estimates that achieving net zero by 2050 requires an average annual investment of $3.5tn globally between 2021 and 2050: a total of $110tn in capital investment. But investors shouldn’t balk at this figure. Actually, it is an opportunity to invest in the future. The real costs to scrutinize are those we incur burning hydrocarbons. As Linda Jackson, Apple’s vice president for environment, policy and social initiatives, said so accurately last year, the choice between a thriving business and a thriving planet is a false one.

Electricity – an increasingly decarbonized resource – will gradually replace our habit of burning fossil commodities, drastically reducing associated emissions and reshaping the energy landscape. This transition is essential to our survival and will improve the economy and the quality of all our lives.

COP29, which will be held in Baku, Azerbaijan, in November, is a monumental opportunity to push ahead with the infrastructure transition required to achieve net zero. The decision to phase out fossil fuels at last year’s COP28 in Abu Dhabi surprised many, but it is a powerful testament to the impact of bold leadership.

Companies and the various organizations that attend COP each year play an important role: they go to COP to remind governments of the need to steer global action toward an agreed and common goal.

At COP29, governments must address how the agreed phasing out of fossil fuels by 2050 can actually happen. What actions do people, corporations and governments need to take to transform the way we use energy? What obstacles need to be overcome, what policies are conducive to the best results, and how can such a wide-ranging transformation take place in the most equitable way?

“COP29’s goal should be a clear framework, in harmony with what was decided at COP28, that defines a roadmap agreed by governments to guarantee that fossil fuels are phased out by 2050.”

It is a very challenging task, but it is far from impossible. Fortunately, we can draw on successful examples and proven blueprints to guide the way.

Over the past 20 years, the electricity sector has made significant leaps in decarbonization – demonstrating how a combination of policies, technological advancements, and collective efforts can overcome early mistakes, misunderstandings, setbacks and initial resistance to change. These efforts have set a clear course toward a fully decarbonized electricity sector by 2050.

This progress, achieved despite early skepticism from sectoral experts, has unfolded exponentially and globally, proving that large-scale, rapid evolution is possible.

Other industries are experiencing similar transformational shifts and can learn from the energy sector’s experience to avoid early mistakes, reduce the risk of obsolescence, and embrace the transition with a clearer understanding of its long-term benefits.

Investors play a key role in driving the transition. They will need to understand where technological advancements are accelerating and where the transition drives value and avoid relying too heavily on patterns that are out of sync with the evolving global economy.

Considering this, private capital’s role in the infrastructure transition will be vital. With its longer investment time horizon, it has a distinct advantage. It brings the needed stability to enable a successful transition. Achieving net zero will not happen in a quarter but over decades. Successful investors will need to take a long-term approach, carefully analyze the secular shifts, and pay close attention to the constantly evolving transition across multiple industries.

Collaboration between the public sector and private capital is key. Countries that recognize the importance of forward-thinking policymaking to accelerate this shift will ultimately be better positioned to attract investment. This creates a competitive dynamic between geographies that is not solely linked to resources or material abundance but to the strength and implementation of policies and legal frameworks that foster and incentivize the right investments.

The recently released IEA World Energy Outlook provides evidence that the goals set by COP28 are achievable. We have the opportunity to transform the energy landscape for ourselves and future generations. Progress on this front, which fuels momentum and drives change, is my hope for a successful COP29 in Azerbaijan.

Francesco Starace is a Partner at EQT where he provides senior insight to support the infrastructure business line’s investment activity, portfolio companies and strategic initiatives. With a career in the energy sector spanning four decades, Francesco brings experience from senior leadership positions, advisory boards, NGOs, and public policy. As CEO of Enel, he was instrumental in driving the company’s efforts to phase out fossil-fueled energy production and invest in digital technologies, transforming it into one of the world’s largest renewable energy producers and the largest system of digitized electricity distribution grids. He is Chair of the Science Based Target initiative, of the Board of the UN’s Sustainable Energy for All, a member of the Rockefeller Commission to End Energy Poverty and served two terms as a member of the Board of Directors of the UN’s Global Compact, from 2015 to 2021.

ThinQ is the must-bookmark publication for the thinking investor.