What U.S. Investors Need to Know About the “Energy Transition”

The threat of the climate crisis is escalating in the U.S., fuelling the demand for clean energy – but what should Americans really know about the “Energy Transition”?

- Renewable energy surpassed coal in the U.S. for the first time in 2022, marking a significant milestone in the energy transition.

Renewable energy sources surpassed coal for the first time in history in 2022, catching the eye of investors as this global shift toward sustainable energy sparks a need for investments in energy transition assets. For some climate-conscious investors, it’s a chance to put their money to work for a cause they believe in. For others, it’s an investment that will pay dividends as the energy transition continues to accelerate.

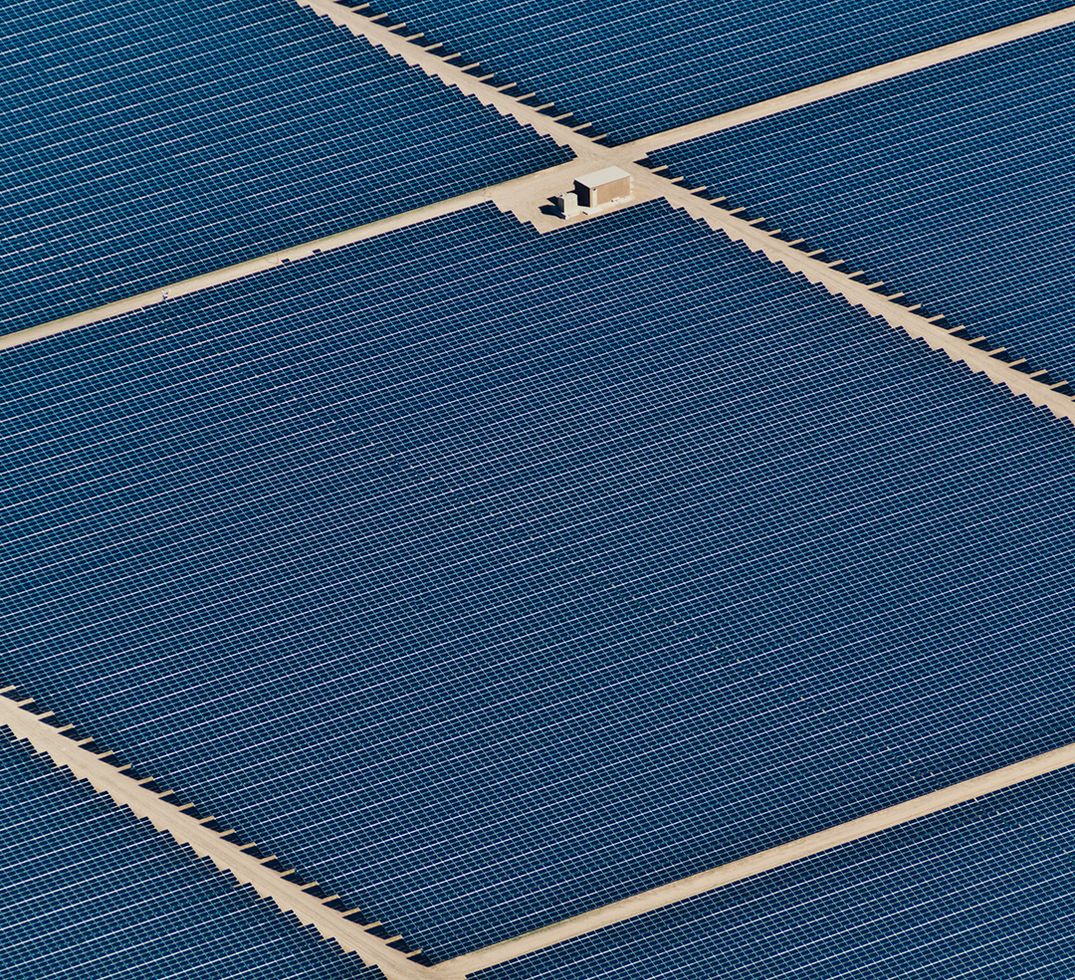

Renewable energy from solar, hydro, wind, geothermal, and biomass came to 13.11 quadrillion BTUs (quads) in 2022, with biomass making up the largest renewable energy source, according to data from Flowcharts. In the same year, coal accounted for just 9.91 quads. As of 2023, renewable energy now generates over 20% of all U.S. electricity, with expectations of continued growth.

According to projections, by 2050, wind and solar power capacity in the U.S. will expand six-fold, and low-carbon hydrogen will account for 5% of the energy mix. Fossil fuel demand is expected to peak by 2030 as capital is increasingly redirected towards these sustainable assets and away from fossil-fuel investments. This is the energy transition.

Over the last few years, Congress has passed several laws aiming to accelerate the pace of decarbonization and incentivize private investors. However, political uncertainties, such as changes in administration, could impact the pace of the transition.

To get on track for global net zero, energy transition and grid investment needs to average USD 4.55trn from 2023-2030, according to data from BloombergNEF – three times the total spent in 2022. This is where investors can step in and play a key role in driving the energy transition. Since August 2022, private capital funds have raised approximately $200bn for new funds, with around half of this amount already invested. A significant portion has been directed towards renewable power production and assets typically classified as early-stage or emerging technology.

As this energy transition inevitably continues to gain momentum, investors must be clued into the implications across various sectors. From transportation and infrastructure to real estate and company ownership, the shift towards renewable energy and decarbonization presents a compelling case for long-term investment. Investors who understand the complexities and opportunities of this transition will be well-positioned to both capitalize on and combat the biggest issue facing our generation.

Transportation

The transportation sector is a major contributor to global carbon dioxide emissions, primarily due to its heavy reliance on petroleum. In 2022, the majority of energy in the U.S. was still being sourced from petroleum (24.6 quads), with lesser amounts coming from biomass (4.88) and natural gas (1.29).

However, the shift towards electrification is gaining momentum, creating new investment opportunities. Clean energy and transportation investment in the U.S. continued its record-setting growth in the first quarter of 2024, hitting a new high of $71bn. This includes investments in electric vehicles (EVs), as well as the infrastructure needed to support them.

The U.S. government has introduced incentives for EV adoption through the Inflation Reduction Act (IRA) of 2022. These incentives are expected to boost demand for EVs and related technologies. Investors should also pay attention to companies involved in the production of EVs, batteries, and charging infrastructure.

The ripple effect of the rise in EVs will significantly drive electricity demand, necessitating further investments in grid upgrades and smart technologies to support increased load and ensure stability. By 2050, electricity is projected to represent 40% of transportation energy demand, with the need for robust and resilient grid infrastructure offering an opportunity window for investors.

Logistics and infrastructure

Electricity grids, energy storage technologies and smart meters are big players in the energy transition. Modernizing the electricity grid is crucial to integrating distributed energy resources, such as solar and wind power, and accommodating the electrification of transport and heating. The demand for power is consistent and less vulnerable to economic cycles, making infrastructure investments a stable and attractive option for investors.

The Infrastructure Investment and Jobs Act (IIJA) of 2021 and the IRA provide generous incentives for upgrading and expanding the U.S. energy infrastructure. These policies are expected to drive significant investments in transmission and distribution systems, ensuring that renewable energy can be efficiently delivered to consumers.

Electricity grid operators, equipment suppliers, and IT firms developing smart grid management software are also positioned to benefit from this transition. Investments in energy storage technologies, demand response systems, and cybersecurity for grid infrastructure are also critical. These investments not only support the transition but also offer long-term returns as the global economy moves towards decarbonization and electrification.

Real estate

Real estate, traditionally peripheral in the energy transition, is becoming increasingly a sector to watch. Buildings account for a significant portion of global emissions, with electricity generated from both renewable and non-renewable sources. Decarbonizing real estate presents substantial opportunities for investors. Green-certified buildings, such as those with LEED (Leadership in Energy and Environmental Design) or EnergyStar certifications, are in higher demand and command rent and sales premiums. They also offer cost-saving through lower utility bills and more favorable financing terms that translate to better returns for investors.

The U.S. government projects that widespread use of LED lighting systems could lead to total savings exceeding $30bn by 2027, while simultaneously reducing the nation’s electricity use. Real estate investment trusts (REITs) focusing on sustainable properties have shown higher returns and dividend yields compared to the broader market. For example, Host Hotels & Resorts, the largest publicly traded lodging REIT, invested $140m in sustainability projects from 2016 to 2020, resulting in annual utility savings of approximately $21m. Green buildings not only reduce environmental impact but also enhance the financial performance of real estate portfolios.

Company ownership

Private equity (PE) firms are uniquely positioned to capitalize on the energy transition and do what they do best: supply investment capital and accelerate growth. Between 2017 and mid-2022, energy transition-related deals in the PE space totaled around $160bn, predominantly in renewables and clean industries.Investors must conduct thorough due diligence to assess the impact of technological, regulatory, and political factors on target companies. Understanding regional differences in regulation and subsidies, as well as the potential for technological disruptions, is key here. Failing to prepare for the net-zero transition poses risks, but proactive investments can see investors reaping the rewards.

Investing in energy transition assets allows investors an opportunity to align their portfolios with sustainability objectives. This sends a strong message and helps create positive relationships with stakeholders who are increasingly prioritizing sustainable practices.

PE firms that get ahead of the pack recognize the dual imperative of playing offense and defense in managing the energy transition. By investing in companies that are well-positioned to thrive in a low-carbon economy, PE firms can generate attractive returns while playing their part in the global shift towards a more sustainable world.

ThinQ is the must-bookmark publication for the thinking investor.