Alex Darden: America’s Infrastructure Moment: Why 2025 is the Year to Build

The rise of technologies like artificial intelligence and renewable energy is fueling an enormous need for data centers, fiber networks, and power grids – all demanding significant investment. The question for investors isn’t whether these shifts will reshape the economy, but just how profound the impact will be.

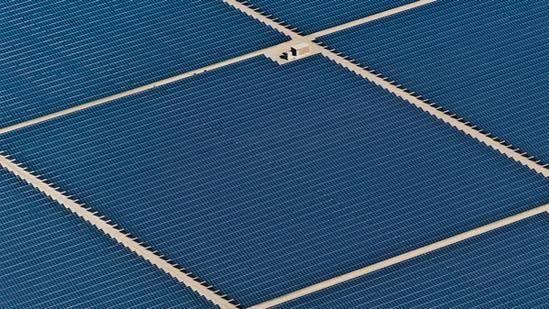

The United States stands on the brink of an infrastructure transformation. The transition to renewable energy, the rise of artificial intelligence, and the enduring progress of digitalization are set to reshape the U.S. economy in the coming decades. This transformation isn’t a distant future – it’s unfolding now and demands hundreds of billions of dollars in investment in new infrastructure like data centers, fiber-optic networks, and power grids.

For companies building and managing this infrastructure, a significant opportunity awaits. The immediate question for investors isn’t whether this opportunity will materialize but rather to what degree it will materialize.

This year has tested the infrastructure sector with supply chain disruptions, rising labor costs, and elevated interest rates. Some argue that 2025 won’t be any different, citing concerns like a potential AI bubble, waning investor interest in climate tech, and looming chip shortages.

But I remain optimistic. While 2024 has been a transitional year, I believe 2025 will be a turning point when the infrastructure sector accelerates and doesn’t look back.

A more acute demand situation and a favorable economic environment will act as a catalyst. The end of election season should provide some regulatory certainty. Anticipated declines in interest rates will make borrowing cheaper, fueling growth.

More importantly, the demand for new physical and digital infrastructure is about to explode. OpenAI wants to build 5-gigawatt data centers; for reference, five gigawatts are enough to power the entire city of Miami. The International Energy Agency projects that renewables will overtake coal as the leading source of electricity next year. Over half of U.S. households are now passed by fiber, with only 23 percent currently connected.

We’re also seeing evidence of rising demand from our portfolio companies. EdgeConneX, a leading global data center provider, has more than tripled its capacity since 2020. Fiber-to-the-home platform Lumos built fiber to 11 times more new homes in 2024 than in 2021.

“After we invest, we don’t sit back. We work closely with our partner companies to scale their operations.”

Right now, I feel the way I did in 2008 when I helped open EQT’s U.S. office. On my first day, I didn’t even have a phone! But we had a strong team and a proven playbook that had made EQT one of Europe’s most successful investment firms. Amid the ups and downs of those early months, we still felt tremendous optimism. And our instincts turned out to be right, thanks to the hard work of our team and portfolio companies.

With the U.S. infrastructure sector on the verge of transformation, our focus is to identify the game-changing companies of tomorrow and help them reach their full potential. At EQT, we do this by taking a disciplined, hands-on approach to drive change.

We start by assessing businesses that provide an essential service to society. While that can include a wide range of companies, we focus our efforts on the sectors with the most potential: digital infrastructure, energy and environmental services, transportation and logistics, and social infrastructure.

Within these segments, we are most excited about the businesses related to broadband including fiber-to-the-home, large scale renewables, distributed energy, the circular economy, logistics infrastructure, and data centers.

But potential alone isn’t enough. We also need strong fundamentals, like stable or increasing demand, predictable cash flows, and pricing power. We have found those characteristics in firms like Fenix Marine Services, a container terminal that the EQT Infrastructure III fund sold for an enterprise value of $2.3bn in 2021 after investing in equipment and processes to support its ability to handle additional volume while simultaneously helping increase its productivity by 20 percent.

After we invest, we don’t sit back. We work closely with our partner companies to scale their operations.

Execution starts with assembling the right team. We want our portfolio companies to field the best talent consistently. To achieve this, we engage with experienced advisors like Michael Tobin, who pioneered Europe’s data-center industry, and Karen Puckett, who helped the internet provider Lumen (formerly CenturyLink) grow its revenue from $2bn to more than $18bn. These industrial advisors, as we call them, provide invaluable guidance and help our companies navigate challenges, seize opportunities and implement growth strategies.

Despite this year’s challenges, I believe infrastructure is ready for a breakout moment. A more productive, connected, and sustainable world is within reach. Together with our portfolio companies, we are not just anticipating this future but actively building it.

Alex Darden joined EQT Partners in April 2008. He is President of EQT Partners Inc. and Head of EQT Infrastructure Advisory Team Americas. Prior to joining EQT Partners, Alex worked at GE Energy Financial Services where he made structured debt and equity investments in energy industry assets and companies. From 1998 to 2002, Alex held various positions within ABB Inc.

ThinQ is the must-bookmark publication for the thinking investor.