Podcast – Ep.3 Helen Clarkson, Climate Group CEO

At COP29, Bahare Haghshenas, EQT's Global Head of Sustainable Transformation spoke with Helen Clarkson, CEO of Climate Group.. Scroll to the bottom of this article to watch the full episode.

Bahare Haghshenas: Hi Helen, it’s great to have you with us today.

Helen Clarkson: Hi, nice to be here.

Bahare Haghshenas: How has COP been so far?

Helen Clarkson:

So far, so good. I’d say sometimes COPs are about the logistics. So actually, it’s incredibly well-organized. They seem to have really got the hosting down.

You can then really focus on the negotiations and what people are saying. That’s obviously the really important bit, but sometimes the setup distracts from or puts people off their game.

So it’s good to be here. It’s a very challenging COP because of where we are. We’ve also already seen some comments about oil and petrostate thinking. So that’s hard.

And the really critical thing is how we get to these financialgoals. So, on that side, it’s really early, but so far, things are going OK, I think.

Bahare Haghshenas: And what are your expectations?

Helen Clarkson:

So the big expectation that we want to see out of this COP is an agreement on this finance goal.

At Climate Group, we’re a nonprofit organization that ismission-driven. We do a lot of work with subnational governments, so states and regions, who are finding it really hard to access climate finance.

So we need to see much more commitment from this COP. And the quantified finance goal – we’d love to see that as the outcome. And then, how does that move through to states and regions and other sub-national actors?

Bahare Haghshenas: As you know, EQT is a private equity firm. What role do you think a player like us has in this conversation?

Helen Clarkson:

I think where we are at the moment is that I attend lots of events, and everyone we work with asks, “How do we access climate finance? How do we get money to do what we need to do?”

But what I hear from the other side is, “Oh, there aren’t enough bankable projects.” There seems to be a mismatch, I think,particularly around risk and ideas around risk and how we assess it.

I hope there’s a role to play in that conversation for interested firms. And the kind of buzzword is blended finance.

I don’t know where you are on that, but I don’t know how much that’s a buzzword and how much it’s a reality. But we’ve got to move from top-level commitments into action, and so much of that is about unleashing this finance.

Bahare Haghshenas: Yeah, and I’ve definitely been listening to the conversation from yesterday and today, hearing exactly the same. What do you think are the key barriers we need to overcome? I mean, blended finance is one. There have to be other options.

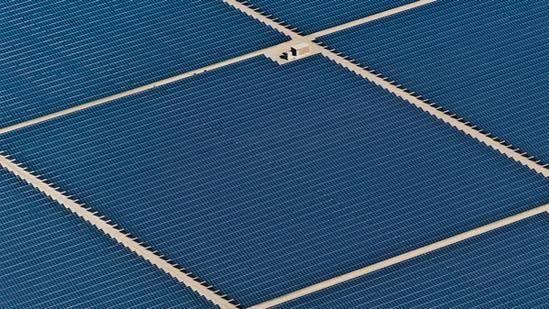

Helen Clarkson: Yeah, and actually, some of the work we do is around how we are going to unleash renewables. We have 400-plus companies committed. They’re global companies committed to our RE100 campaign. That’s a global commitment to 100 percentrenewable electricity.

Every year we check in with them: How are you doing? We measure their progress. A lot of them are making really good progress, but we also say to them, ‘Where are you not doing well? And what’s stopping you in those countries?’

They have investment ready to go, and they’d like to be using renewable energy. What they talk about is regulatory and policy barriers. So that’s a lot of what we work on.

And it’s really interesting when you get into the nitty-gritty, and it’ll really vary in different countries. But somewhere like South Korea, which is very hard to buy renewables, when you look at the regulation, there’s a regulation that controls where you can put solar and says you can’t put solar in a lot of places within 100 meters of residential dwellings.

Well, if you think about the rest of the world, we’re putting solar on top of our residential dwellings, alongside roads and so on. And if you’ve got sort of siting regulations that actually stop you from doing that, of course, the rollout of solar is going to be limited.

And when I go to South Korea, they say, “Oh, we can’t do solar here.” Well, it’s not that you can’t – you’ve got the same sun as other countries. It’s that sort of regulation that we’re looking at and saying, “OK, how do we get rid of really specific things?”

Permitting and siting regulations are everywhere in the world. The UK is now saying it’s going to do much more. The new government in the UK said, “Right, we’re going to go after this.”

If you compare a country like China, which doesn’t have these issues for obvious reasons, they can get a wind farm in four months. That wind farm would take four or more years in the UK. And the difference is permitting.

You might not want to go to a fully centralized ‘do what we say’ system, but how do you change the presumption around that? Every individual view counts versus the planet’s.

How do you take the presumption, ‘We’re going to put this up. You can object to it in the background, and we’ll let that process run, but we’ll keep the process moving,’ rather than keep stalling it. That’s what’s happening in a lot of places like the UK and other European markets.

Bahare Haghshenas: So, policy and long-term policy areabsolutely key.

Helen Clarkson: Yeah, and I think we’d also like to see investors engage on that. How do we hear back, as well? Which policies are stopping investors from making investments?

Because they might be able to identify that and work with organizations like us to go after those policy barriers.

Bahare Haghshenas: Climate Group. Tell me more about that.

Helen Clarkson: So, we’re an international NGO. Our mission is to drive climate action fast.

“I think we’d also like to see investors engage on that. How do we hear back, as well? Which policies are stopping investors from making investments? Because they might be able to identify that and work with organizations like us to go after those policy barriers.”

Helen Clarkson: We’re headquartered in the UK, but we have a big office in India. We’ve got another big office in the U.S. and small offices in Beijing and Amsterdam.

So we work globally. We build these big networks, which have commitments at the center.

On the corporate side, there are 100 percent commitments to renewable electricity, electric vehicles, or zero-carbon steel and concrete.

Then, we run the Under2 Coalition, a coalition of subnational governments. With all of them in the network, we’re bringing organizations together to learn from one another and to move faster on their own emissions reductions. But we’re also aggregating those signals and using them to move policymakers.

For example, in South Korea, we’ve got 50–60 companies there, either South Korean or global companies with a presence. Because they’ve made this commitment, you can go to policymakers and say, “Look, there’s investment ready to go, but actually, this is what’s preventing it,” and try to push the government.

Equally there are things like Lego, for example. They’ve got a global commitment and were building a new factory in Southeast Asia but were quite neutral about where it went. So they did a sort of beauty parade, and Vietnam won that.

It’s a billion-dollar investment in a new factory in Vietnam. And so it’s using that commitment to then drive real change in markets.

Bahare Haghshenas: It sounds like you’re using that platform to drive systemic change.

Helen Clarkson: Exactly. We talk about systems. We talk about energy, transport, heavy industry, and now we’re starting work on food, which is very complicated.

Bahare Haghshenas: Aside from policy, where are the other barriers?

Helen Clarkson: Policy and money, I think, are the biggest barriers. Policy can be on different levels. Whether it’s like the example I gave you, that kind of specific regulatory level, or it’s at the national level.

For example, if you look at somewhere like the U.S. now, there will be a big, massive change in government that swings the pendulum. When you talk to businesses about what they want, they want certainty and a level playing field.

Most of those companies are not actually competing on where you get your electricity; they can collaborate on that. It’s not a competitive issue. But they don’t want things to keep switching and changing.

Bahare Haghshenas: This is my first COP, and I was fascinated yesterday. You meet thousands of people from every sector, every industry, and every organizational background around the entire globe. When I went to bed, I thought, “What an amazing wealth of knowledge.” And then I wondered, “Why aren’t we doing this faster?”

Helen Clarkson: Yes. Vested interests are stopping us.

There’s still a lot of money to be made in fossil fuels, and it’s really hard for companies in that space, or investors, to say, “Actually, we’re going to say no to those profits.”

We’ve seen it more than ever in the last few years. When you look at COP26 in Glasgow, it was probably a peak of ambition in a way.

That was year two of the pandemic, and I think the pandemic shifted things a bit as well. But then we were getting into the Ukraine energy crisis and things like that. Suddenly, you had all this ambition and could see the world transitioning.

But then we started to enter this other era of super-profits. You saw all this chatter from fossil fuel companies saying, “Oh, what we need to do is keep making money off fossil fuels. And then we promise we’ll invest that in renewables.”

Well, they didn’t. They did share buybacks, right? At that point, you could see it wasn’t genuine.

Helen Clarkson: And now there’s this big problem I call the ‘last barrel of oil’ problem. When you look at climate projections for 2050 or energy projections, most of them say there is still oil in the mix in 2050.

So, everyone just uses that as an excuse. I’ve heard it from many oil majors: “Well, there’s still oil in the mix.” Fine, but why does it have to be you selling that oil?

The problem is that because the economics are now shifting back toward fossil fuels, there’s inertia. Why should a company go to its specific investors and say, “We’re going to take a hit?”

It’s a proper collective action problem. And that’s where we come back to governments needing to set the frameworks and the standards.

Bahare Haghshenas: But we’ve seen a big shift in the last 10 years, haven’t we?

Helen Clarkson: Yes, absolutely. Paris really made a difference because it gave that very long-term signal: This is where the world is going, and this is where you need to be investing.Going into Paris, the estimate was that we were on a trajectory of five to six degrees of warming. We’re now more like three degrees. We haven’t come nearly far enough. And that last bit is the hardest piece.

We’re seeing now that we’re getting to the harder end of it. The easy stuff has been done. But Paris showed that pledges can send the right signal, and it made a difference.

Bahare Haghshenas: What do you hope we’ll achieve by the end of this week?

Helen Clarkson: I hope we’ve got somewhere on this quantified finance goal. We’ve had a few new NDCs announced, the nationally determined contributions under Paris by which countries make their commitments. I’d like to see a few more of those. Let’s get some good news and show how people are stepping up.

We’re also really interested in concrete actions. How do you turn those pledges into action? The more examples we can bring and share with the world, the more hope we can give people, and the courage to do more.

Bahare Haghshenas: And looking ahead to next year’s COP in Brazil, what do you expect?

Helen Clarkson: Next year is a big year. All the countries need to release their updated NDCs, which will be crucial in that sense. We’ll also get a sense of where the ambition is and how the new U.S. presidency might affect it.

Next year, COP is going to be in Brazil. They’re saying it will be in the Amazon. That’s an important signal – bringing COP to a place that represents nature and its importance.

Bahare Haghshenas: If you ask people, “Do we need change?”everyone will say yes. But if you ask, “Do you want to change?”the answer is very different.

Helen Clarkson:

Yes, exactly. And that’s part of the issue – there will be pain. I think people are missing how much more pain there will be if we don’t change. The transition will require adjustments, like changing homes or finding financing for upgrades. These things are hard, but we need to get people on board with the journey.

Bahare Haghshenas: That’s why I love Climate Group’s mission to drive systemic change. The voices around the table really can make a difference.

The views and opinions expressed in this interview reflect those of the participants and do not necessarily represent the official policies, strategies, or commitments of EQT AB or its affiliates.

ThinQ is the must-bookmark publication for the thinking investor.