Can Clean Energy Cope with Our Growing Data Demands?

With our data needs increasing, some are wondering where will all the energy come from? Sarah Drumm finds out.

- Data demands are on track to expand faster than the energy transition.

ThinQ: Hey ChatGPT, how much energy do data centers consume?

ChatGPT: About 1% to 2% of the global electricity supply.

That query alone used 2.9 watt hours, according to International Energy Agency (IEA) estimates. By comparison, the two Google searches we conducted next to check if the information was correct used just 0.6 watt hours, about 10 times less per search.

These numbers add up quickly. It takes just 37 queries to use as much energy as boiling the kettle does, while ChatGPT’s overall estimated daily energy consumption of 500,000 kWh is enough to power 180,000 US households. In the next year and a half, the IEA reckons data center energy consumption will double, reaching a level roughly equivalent to Japan’s energy usage. The AI boom is driving this, but cloud-based services, expanding 5G networks and even activities like crypto mining are also guzzling more and more electricity.

Those working in the background to make sure AI’s potential can be realized — from the data centers and energy suppliers to big tech firms themselves — have profound concerns about what they’re seeing. Where will they get all this energy from?

“The grid hasn’t changed a whole lot in the past 100-plus years,” says Richard Walsh, the co-founder and CEO of Madison Energy Infrastructure, a distributed energy provider and EQT portfolio company. “If Thomas Edison were to come back today, he would look around and say, ‘No shit! It’s still the same’.”

The problem with powering data centers

The world’s grids are already creaking under the strain, with countries including Singapore, the Netherlands, and Ireland refusing to allow some new data center projects to go ahead. The fear is they could guzzle so much renewable energy that there won’t be enough left to decarbonize anything else.

“Data centers are expanding faster than the energy transition,” says Ayse Coskun, a professor of electrical and computer engineering at Boston University. “Building and connecting data centers [takes] one to two years, but expanding power grid capacity often takes much longer.”

Due to the slow pace at which new transmission power lines are being built, it now takes five years for new energy to be added to the grid in the US. There is now a 2.6 terawatt backlog of energy projects waiting to be plugged in — making the queue twice the size of the existing grid itself.

Without a solution, energy transition efforts could falter, with natural gas providers already swooping in to cover the shortfall.

Breaking the renewable power ceiling

A raft of solutions are being explored to solve this problem. A dormant power plant in Pennsylvania — which was also the site of the U.S.’s worst-ever nuclear accident — may be switched on again in a bid to meet AI energy demands. Meanwhile, Scotland is trying to sell itself as a destination for hyperscale data centers given its proximity to renewable power generation sources.

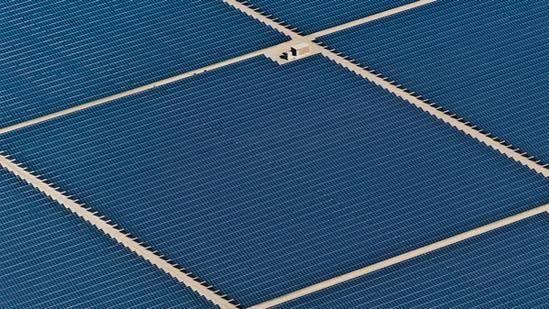

Zelestra, previously known as Solarpack, is a Spanish solar power plant developer acquired by EQT in 2021, which works with customers to achieve decarbonization. It does this by helping customers decide where to locate both data centers and renewable projects, to improve off-grid supply reliability. While data centers have typically been built close to customers, today, “the criteria new data centers need to consider [are] power network availability and planned growth,” says Chief Commercial Officer Ivan Nieto. “This makes behind-the-meter or co-colocated energy projects more interesting. We help [customers] analyze power market challenges and design a realistic approach.”

Earlier this year, Zelestra struck a deal with Meta to construct two solar projects in Indiana as part of the social media company’s $800m efforts to build a data center campus in the state.

Distributed solutions like this are “what data centers need”, says Chudgar, as they provide relief for struggling energy grids and provide an alternative to waiting for additional renewable supply to hit the grid.

These efforts will hit a ceiling at some point, though. Zelestra’s Indiana solar farms will have a total capacity of 210 megawatts — a significant amount of energy, but not enough to cover the 11.5 terawatt hours of energy Meta used in 2022.

The opportunities to invest are huge. Private capital will provide an important source of funding when it comes to making upgrades to the grid, but governments will also need to lead the way in rethinking regulations that make it difficult to build and connect new infrastructure. The incoming UK government has voiced its intent to get renewables onto the grid, having just approved plans for three new solar farms. Residents have voiced concerns — but the government argues development is a “win-win” for the country.

“I’m sure everybody wasn’t pumped when we built the highway system, but there’s no question the grid needs to evolve,” says Walsh. “You’re going to need huge wind farms, huge utility-scale, big batteries, long-duration storage, and electric vehicles as little grid assets that are floating around. You’re going to need a village, truly, to hit this energy transition.”

ThinQ is the must-bookmark publication for the thinking investor.