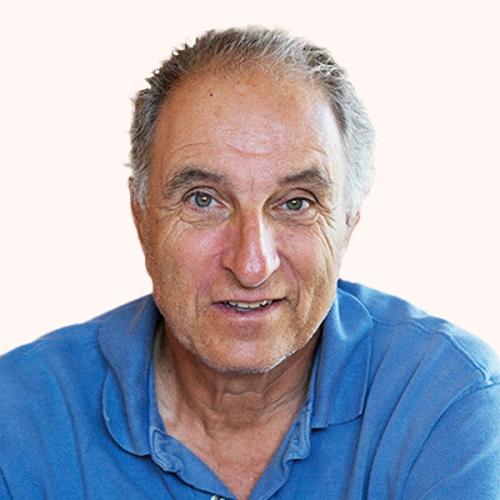

Lennart Blecher: How we Launched EQT Infrastructure. Despite Being Told Not to.

Sometimes, you just need to ignore others and forge ahead.

I have done the math. If we had listened to everyone who told us that creating an infrastructure strategy was a bad idea, EQT’s metaphorical wallet would be in the region of €30-50 billion lighter.

Doing as we were told would, in that case, have been a very costly mistake.

One of the most defining things about life at EQT is that it isn’t enough to be right. The waste bins of huge corporations are piled high with memos and presentations of rejected bright ideas.

If you want to be bold and change the world you need: Determination. Entrepreneurship. And, when the need arises, you need to be forthright enough to tell others they are wrong, including your boss.

The story of how we created EQT’s first infrastructure strategy exemplifies those virtues. It is an example of how being forward thinking, combined with a healthy contrarian spirit, led us to become a market leader.

Today, value-add infrastructure is the backbone of many of the biggest and strongest-performing investment firms. But this wasn’t always the case.

Not that long ago, had you suggested investing in “boring old reliable infra” I’m sure you’d have been laughed out of some meeting rooms. In fact, I know this to be true because when I first pitched the idea of creating an infra strategy at EQT, the answer was “No.”

But before we get to that, let’s start with the beginning — back even before EQT.

To understand how infrastructure investing became the backbone of the Private Equity industry, you have to go back to the privatization wave of the 1980s.

I spent 16 years at ABB Group. Siemens, ABB and GE were all major infrastructure providers in their respective fields. At that time, nobody called it an “investment strategy.”

But a wave of privatization and growth into what would now be called infrastructure left a lot of organizations looking at how to keep their businesses going.

Suddenly, the people who made powerplants weren’t being asked to make a new power station; they were being asked to provide 240 megawatts of power.

Forward-thinking groups like ABB were beginning to build up their own ways of raising equity and managing debt to strengthen their handle on the market.

From the late 90s to the 2000s, that’s what I was doing. Then came the rise of bank-sponsored funds. By the mid-2000s, banks spotted an opportunity and started raising money from institutional investors, deploying it into core infrastructure assets like highways and ports.

But still, no-one had yet spotted the next wave and the biggest opportunity by far: value-add investing.

The banks had sought to “deploy capital.” That was really just financial engineering. But, as I had seen, riding the first infra-wave with groups like ABB — adding value to infrastructure companies, helping them with capital to grow their fundamental business or reach into new markets — was extremely attractive.

ABB was a Wallenberg founded-company and, through that connection, I got to know Conni. We had the idea of launching a strategy for EQT specifically. I thought that if EQT could be the first to use a private equity investment model to infra we would have quite a head start on the competition.

Not only because we were going to be one of the pioneers in this space, but also because we had the Wallenberg industrial network at our disposal.

Take, for example, the Wallenberg sphere of influence companies: ABB built the world’s energy and rail transportation infrastructure. Ericsson built the world’s communication infrastructure. We had access to industrialists with deep knowledge about how the modern world around us had been built — and how it was going to need to be built in the future.

Our heritage would become our infra superpower. We approached the challenge with an industrial background; meanwhile, the rest of the industry was mainly offering ‘financial services’.

In 2007, Conni invited me to start an infrastructure strategy at EQT based on the private equity philosophy they had been successfully practicing since 1994.

We would take the advisory network concept; identify infrastructure companies where we could parachute in good, seasoned industrialists to drive operational value creation. Conni and I both knew this would be something new in the market.

So, I brought along some colleagues from ABB, GE and other smart people I had met like Andreas Huber, and we drafted a strategy based on instinct and our knowledge of the market.

Then came the day we pitched it to the EQT partners, including Thomas von Koch, Christian Sinding, Caspar Callerström, Jan Ståhlberg, Marcus Brennecke and, of course, Conni. I wouldn’t say I was confident leaving the meeting — but I didn’t predict what happened next.

I tracked Conni down in a corridor and pushed him for an update – but it wasn’t good news. “They all said no,” he told me. I won’t pretend it wasn’t a blow.

I had come all this way, moved in a team of experts and now the answer was just: “No”. Not even a “No, but...”

But then something strange happened, I couldn’t help but notice Conni didn’t seem in the least bit despondent.

Here I was quietly seething and meanwhile Conni was chatting away, seemingly oblivious to the fact that I was feeling cut down. I asked him: “So, what do we do?” hopeful that his upbeat attitude might be concealing a glimmer of hope. It was.

“We’re doing it anyway,” he said with a reassuring smile.

“But what about the Partners?” I asked.

“Don’t listen to them,” Conni replied with a confident wave of his hand. “Those guys in there, they will catch on soon enough!”

Of course, I had questions (mostly: “What was the point of the pitch?!”). But there would be plenty of time for all that. Conni’s optimism was infectious. We immediately jumped into making grand plans for the future.

I wanted to make this work in North America. I could see the opportunity and I knew that the market there was ready for what we were going to offer.

The result was that EQT opened its first North American office and our first infrastructure fund.

By anyone’s standards, I think we can call that a “success.”

If there is a moral to this story, it is a pretty simple one: Don’t always do as you are told. Sharing your ideas and getting them validated is always a good plan, where possible. But, if you really want to do something great, don’t wait for the world to catch up with your ideas.

ThinQ is the must-bookmark publication for the thinking investor.